Debt Obligation

-

Transparency Star for Debt Obligations

Transparency Star for Debt Obligations"By providing taxpayers with essential debt information in a variety of formats, Katy ISD has shown a true commitment to Texas taxpayers."

- Texas Comptroller Glenn HegarDebt Overview

Texas Comptroller Transparency Star for Debt Obligations

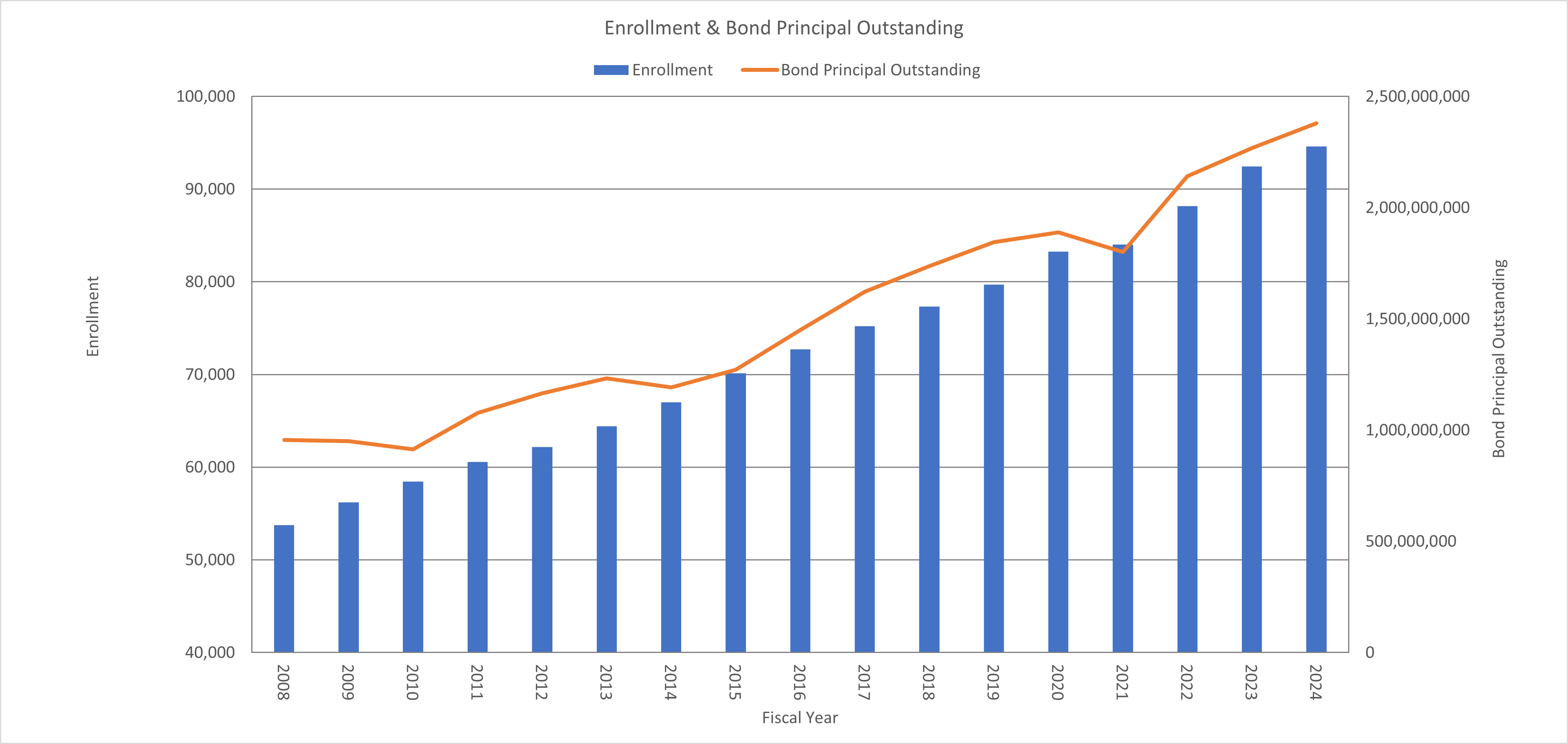

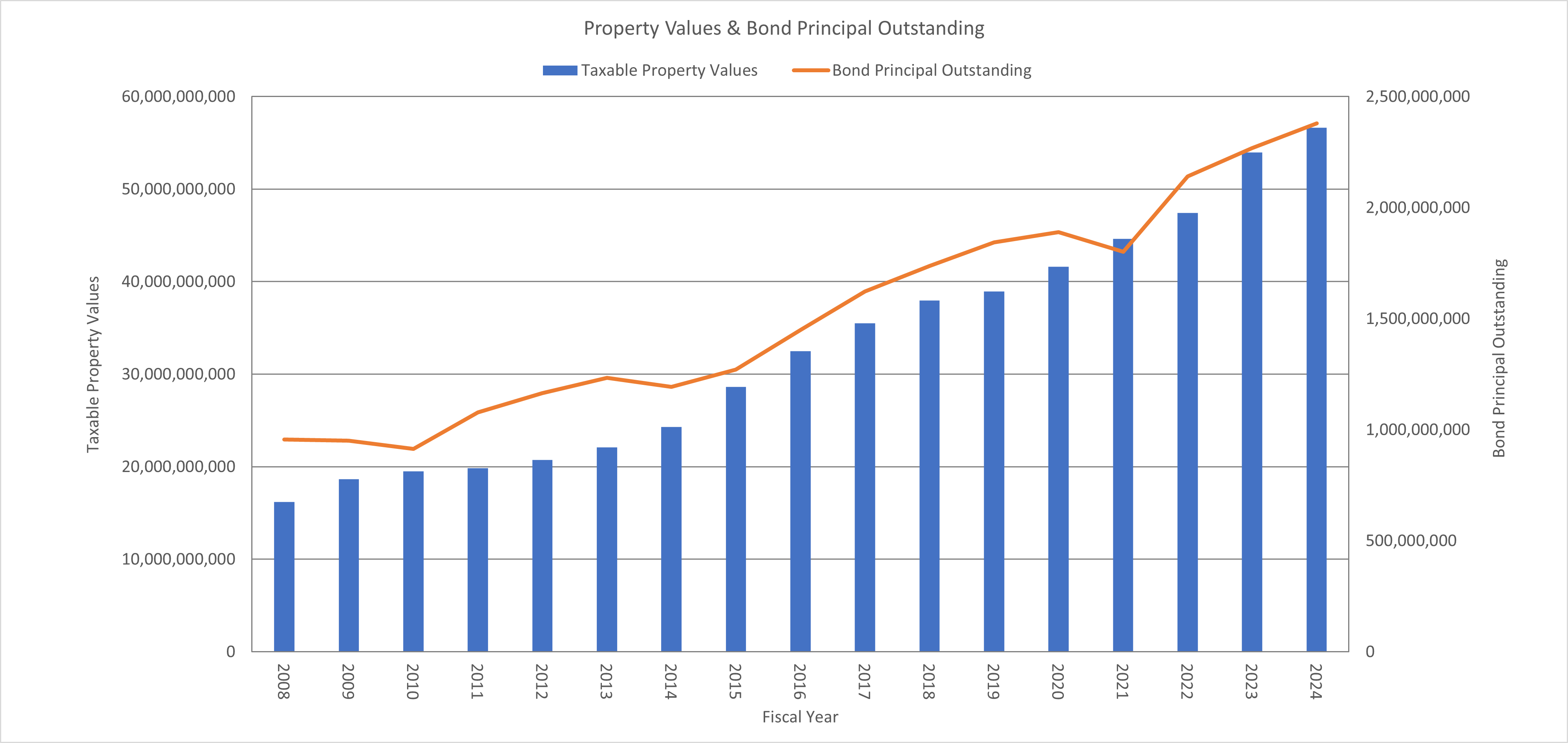

Governmental entities such as municipalities, state agencies, and school districts like Katy issue bonds to finance major capital expenditures. These include constructing and equipping schools/district facilities, building additions, renovations, equipment retrofits, school buses, portable buildings, etc. Bonds authorized by voters by a majority vote in a bond election are issued by the District based on cash needs for the projects.The Debt Service/Interest & Sinking Fund is used to repay the bonded debt, both principal and interest, over time. The District uses the issuance of bonds to finance facilities in the same manner a homeowner uses a mortgage to finance a house over a period of time.

The District tax rate is made up of two parts. The Debt Service/Interest & Sinking tax rate is set each year to generate tax revenue sufficient to repay debt payments for the year, while the Maintenance & Operations/General Operating tax rate is used to pay for the day-to-day operations of the District.

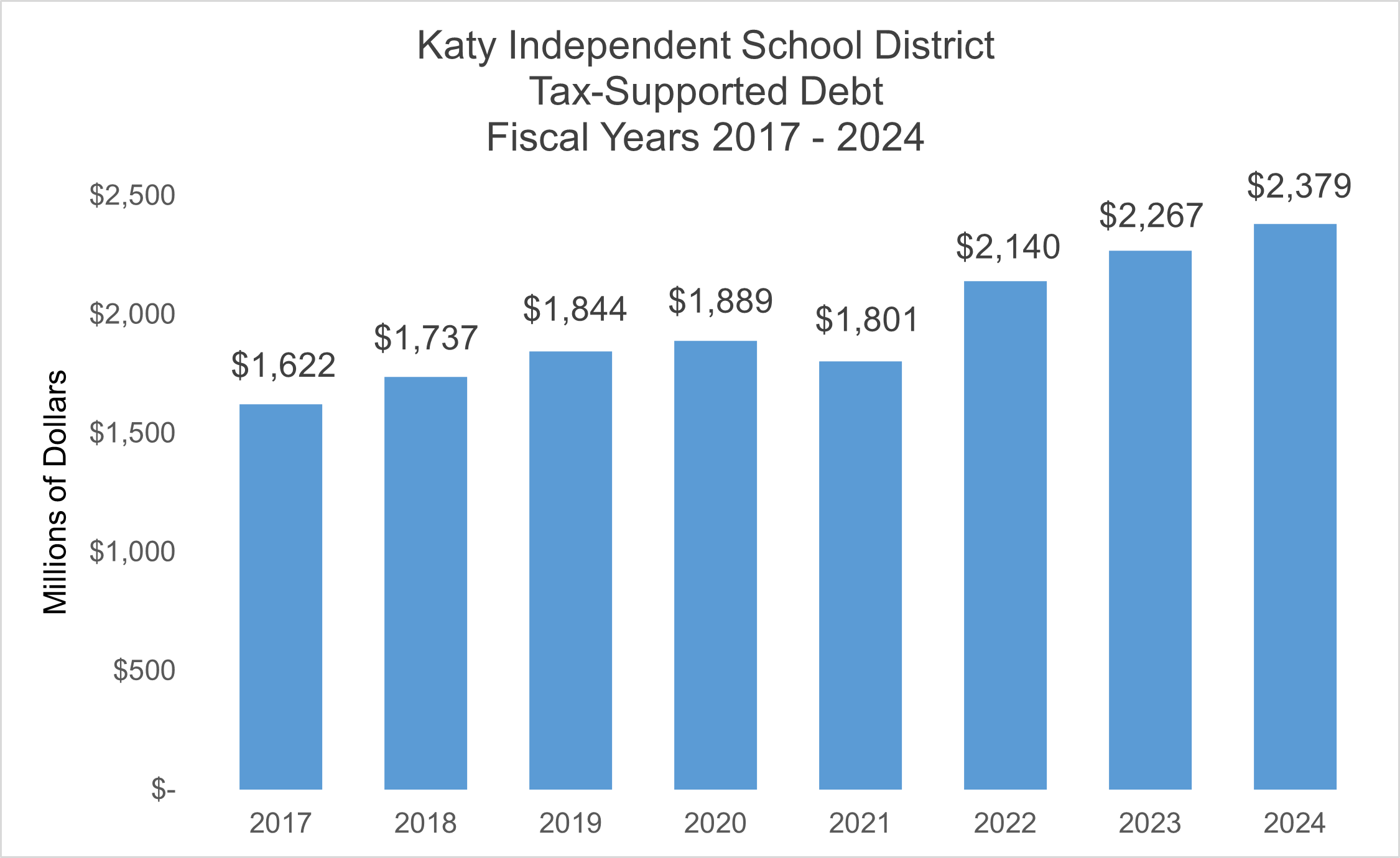

Debt Summary (visual)Debt information is presented for each debt issue as of August 31, indicating the total amount outstanding and the per capita amount. Population estimates are provided by the Municipal Advisory Council of Texas (TMR Report). The District has no revenue-supported debt obligations or lease related obligations.

Tax Supported DebtOutstanding General Obligation debt is presented as of the fiscal year ended August 31, 2023.

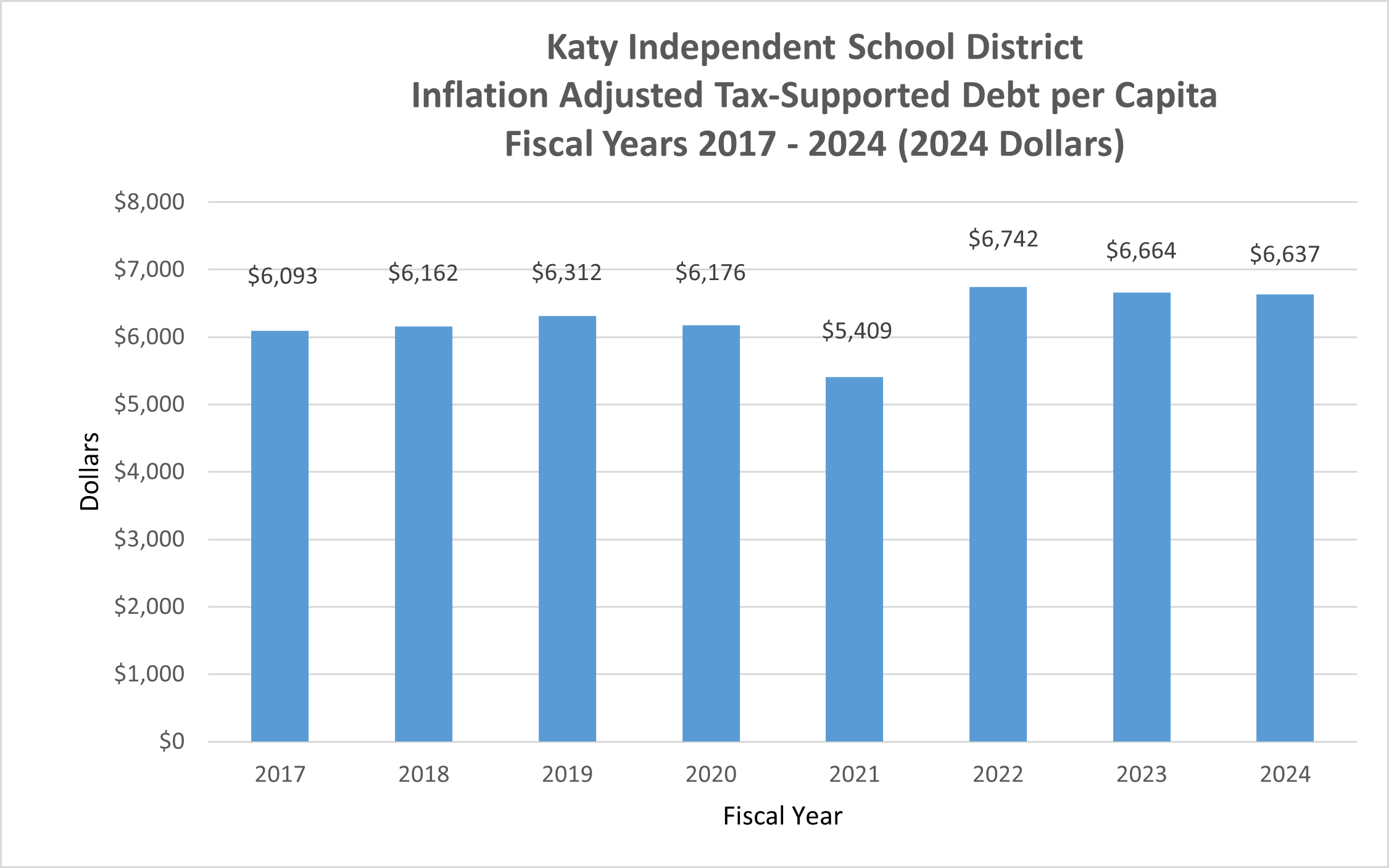

Inflation Adjusted Tax Supported Debt per Capita

Debt per capita is calculated using population estimates provided by the Municipal Advisory Council of Texas (TMR Report).

-

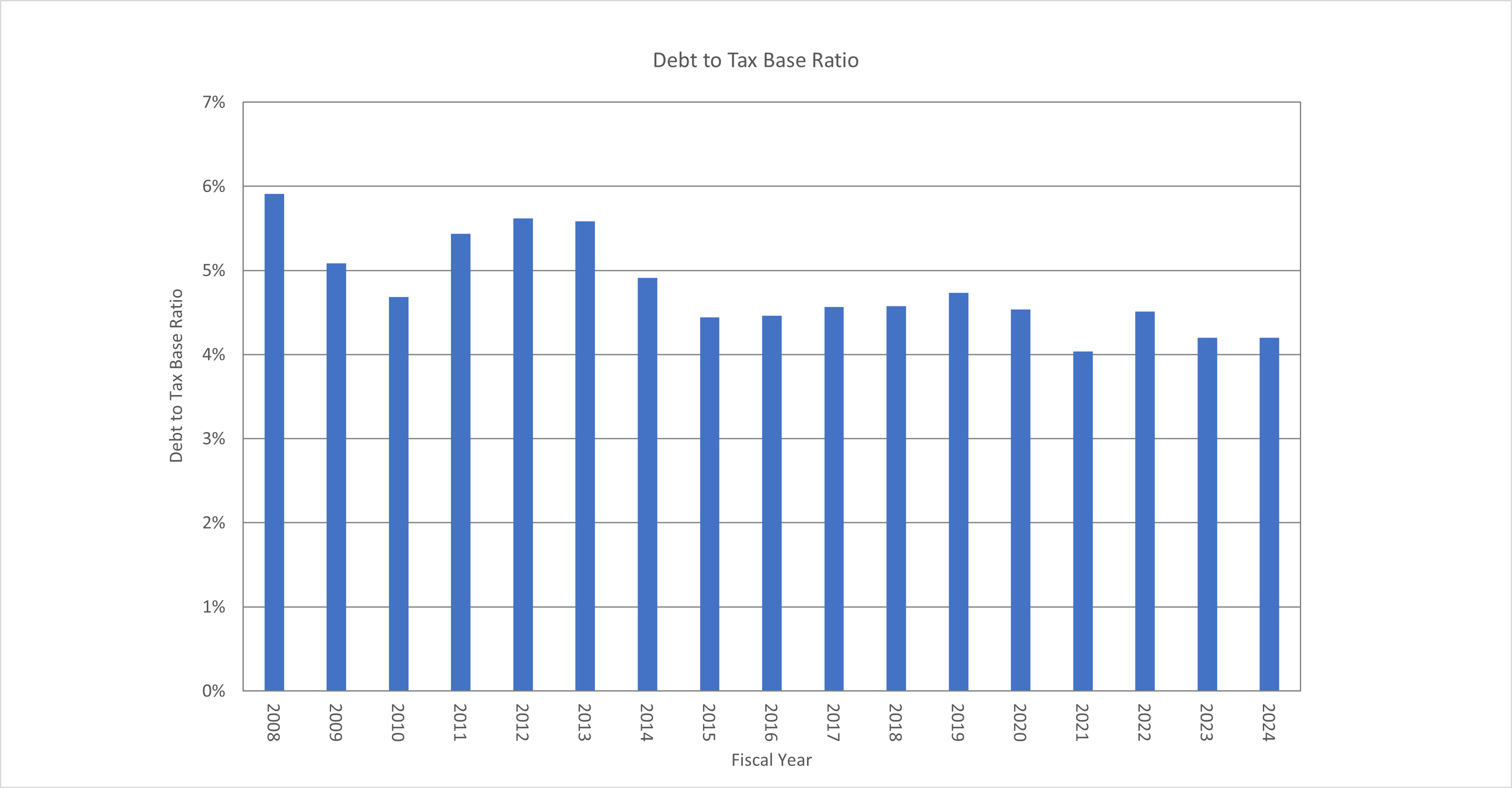

Debt Ratio: Fast Growth School Districts

Tax Rates 2024-2025

Resources

- Debt Information in previous years' adopted budgets dating back five fiscal years

- Debt Transparency Report - HB1378

- Historical Bond Election Information

- Interest & Sinking Tax Rate and Principal Paydown Commentary

- Issue Bond Listing - Excel

- Issue by Issues Bond Listing

- Outstanding Tax Supported Debt for Last Eight years - Excel

- Outstanding Tax-Supported Debt for Last Eight Years

- Pending Bond Sales

- Texas Bond Review Board

- Texas Comptroller of Public Accounts - Debt At A Glance