Traditional Finances

-

Financial Summary (visual)

Financial Summary (visual)

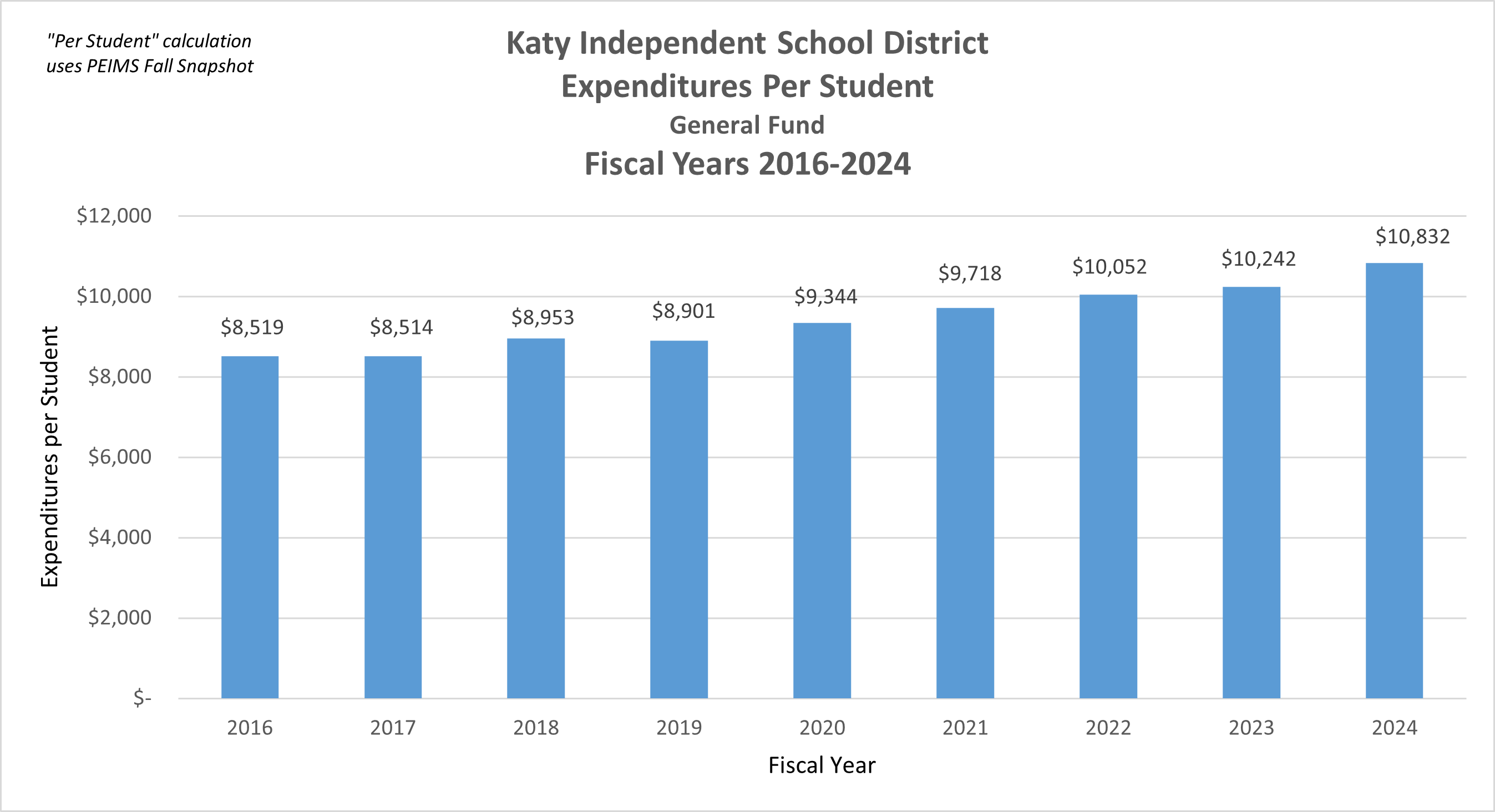

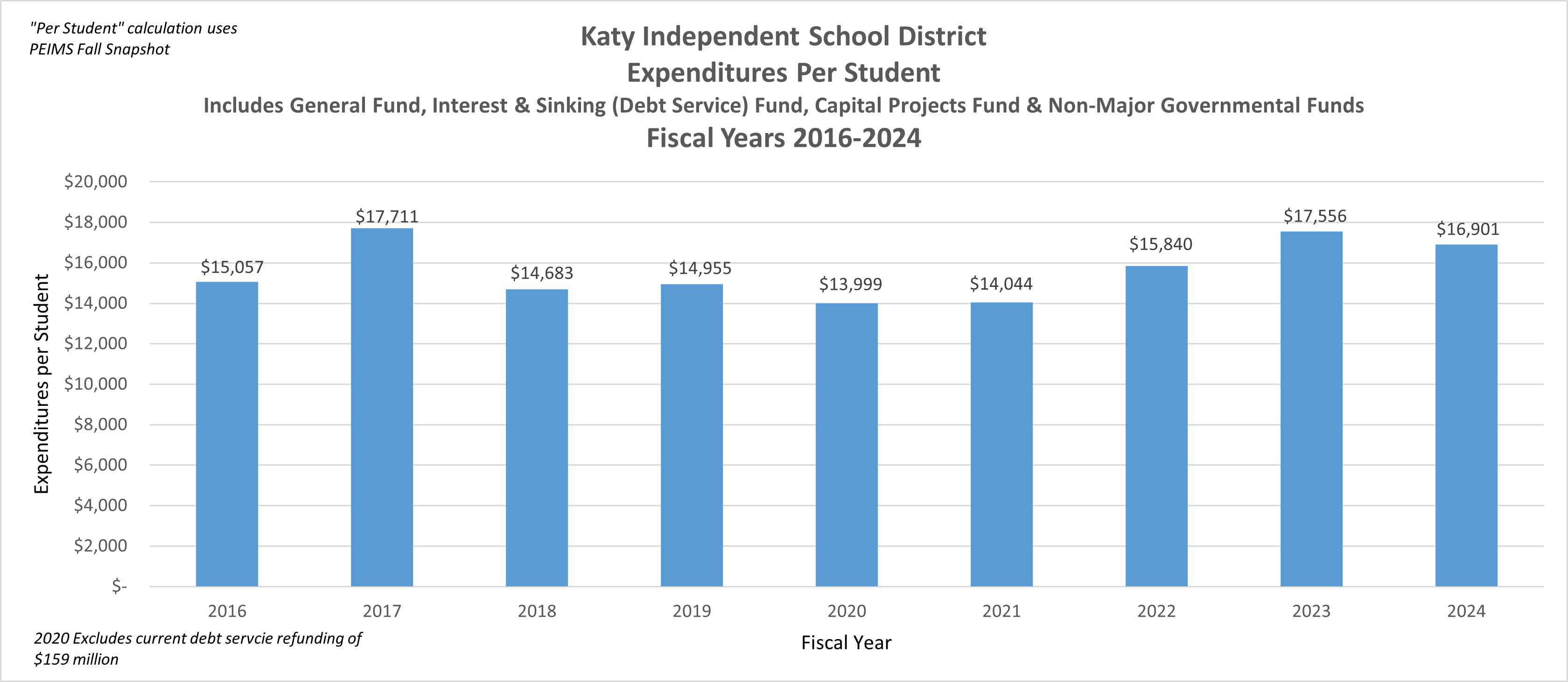

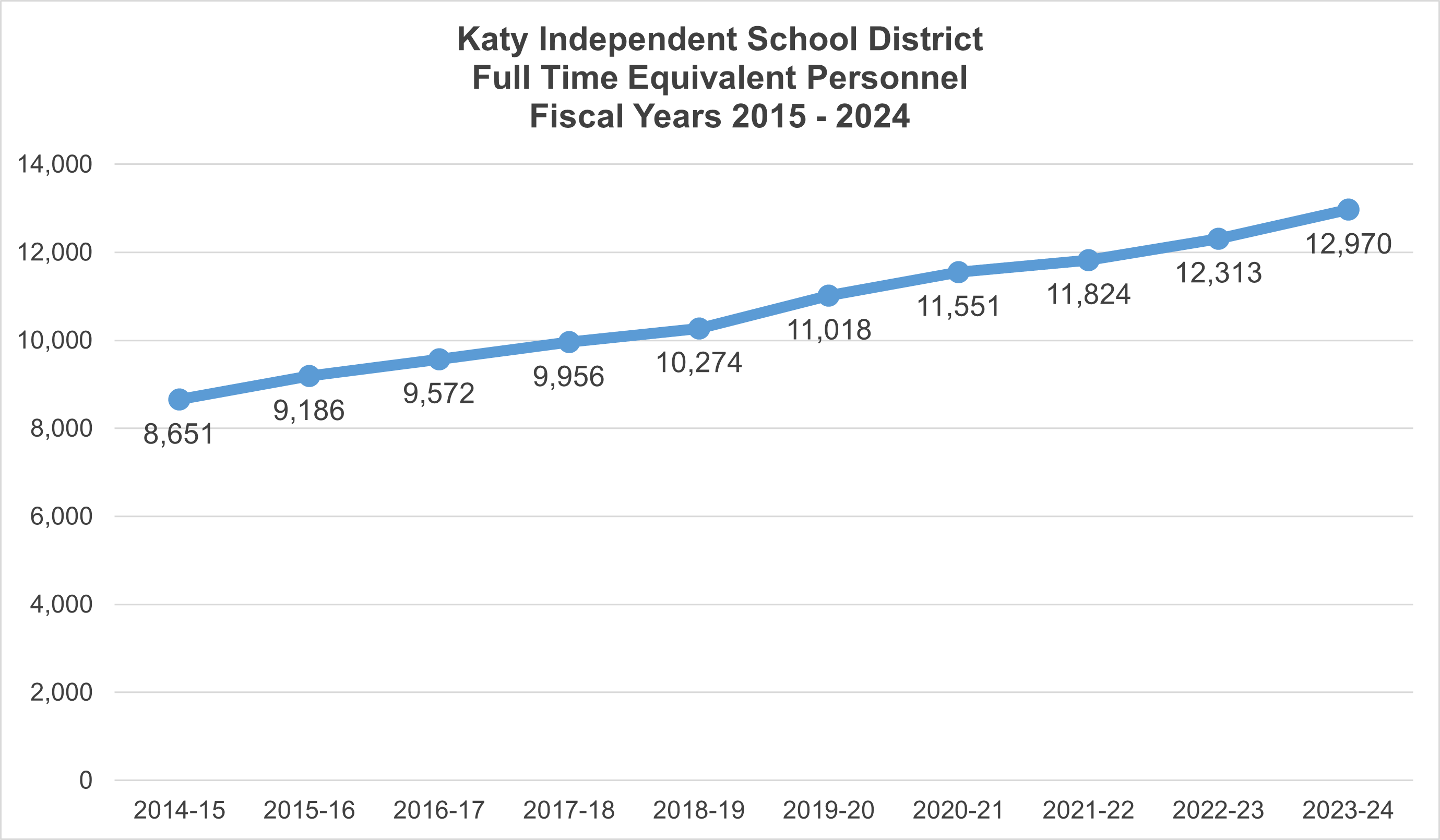

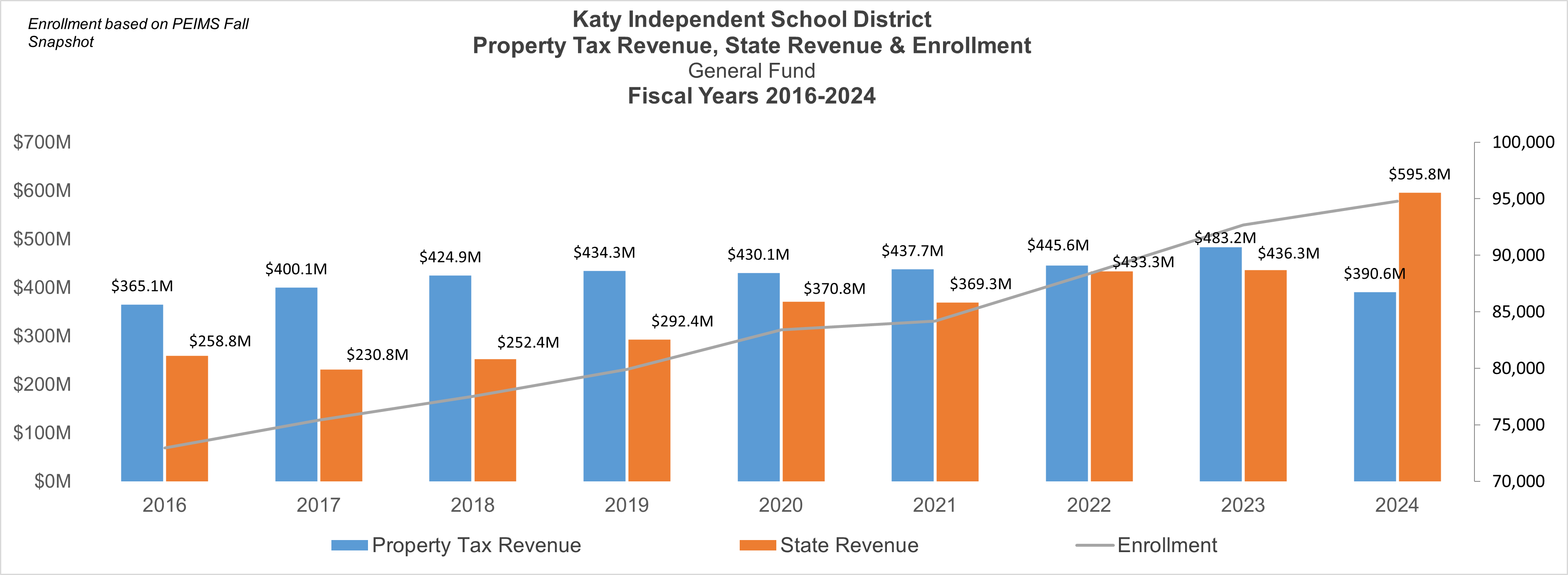

Financial information for the year ended August 31, 2024 is presented including expenditures on major objects such as payroll, contracted services, supplies, other operating costs and capital outlay. These are presented in total for the year and per student. Enrollment numbers are from District records. Revenues are also presented by major categories including property tax revenues, other local revenues, state revenues and federal revenues for the year and per student. The District does not assess sales tax as a revenue source. Full-time equivalent (FTE) personnel are presented and represent a calculation of the number of employees working for the District stated as full-time positions only.Expenditures Per Student

Expenditures per student are presented with two different sets of data. The first is calculated using audited financial statement data for the Maintenance & Operations/General Operating Fund only. The Maintenance & Operations/General Operating Fund is used to account for the day-to-day operations of the District and does not include financing costs or construction costs. The second is calculated using audited financial statement data for all funds (Maintenance & Operations/General Operating Fund, Interest & Sinking/Debt Service Fund, Capital Projects Fund & Non-Major Governmental Funds). This aggregated data varies more from year to year due to the timing of construction projects and debt repayments.

Full-Time Equivalent Personnel

Full-time equivalent personnel represents a calculation of the number of employees working for the District stated as full-time positions only. Thus, two half-time positions would count as one full-time equivalent in this presentation. Staffing levels may vary throughout the year. This information is from district records as presented in the Comprehensive Annual Financial Report.

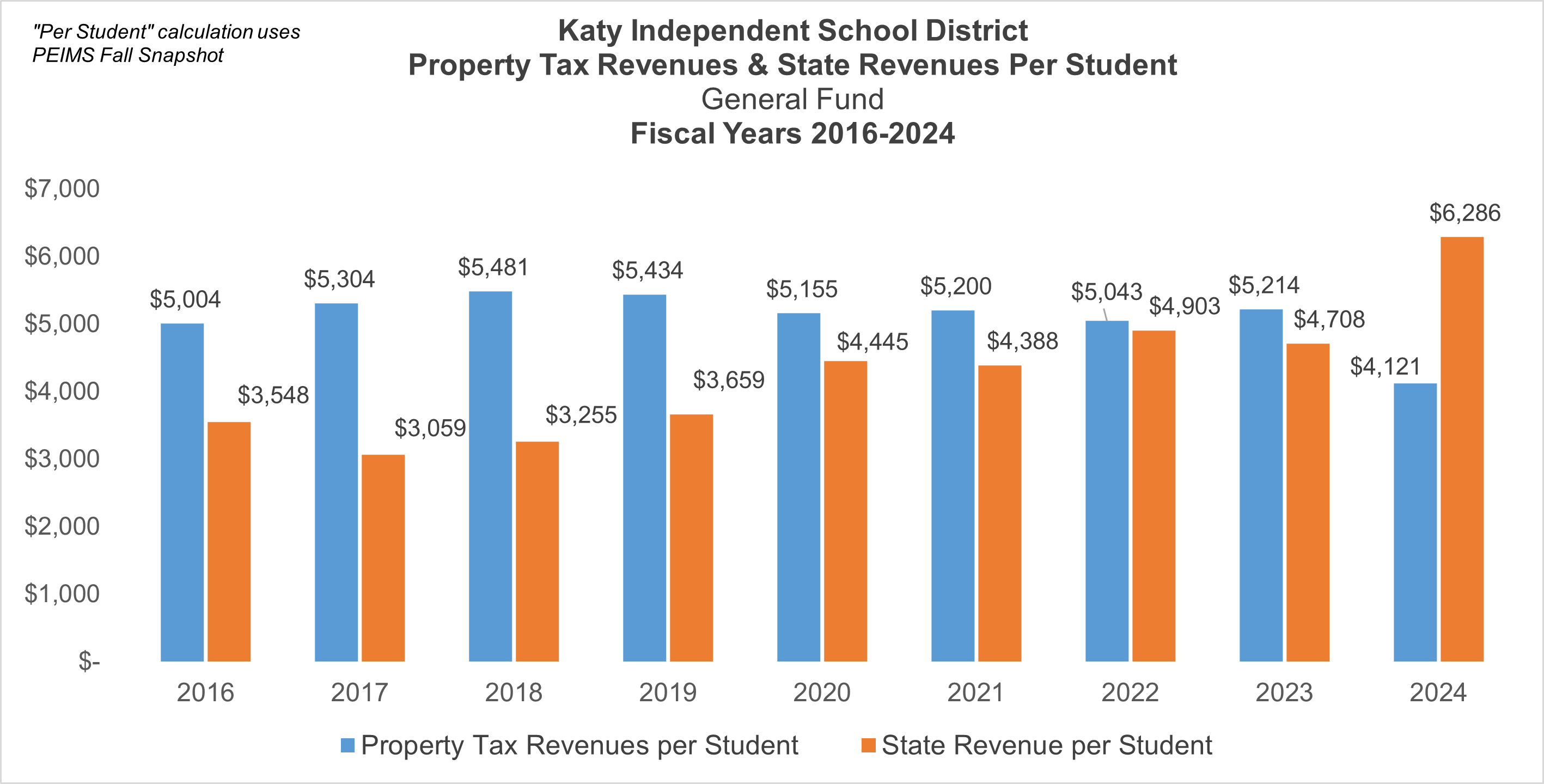

Property Tax and State Revenues

Property tax revenue includes property tax collections, penalties and interest, and other tax-related income. State revenues are primarily made up of funding provided by the State of Texas based on state funding formulas, Teacher Retirement contributions made on behalf of District employees, and state aid provided for Debt Service to hold districts harmless for mandated increased exemption amounts. This information is presented here with two different sets of data. The first is calculated using audited financial statement data for the Maintenance & Operations/General Operating Fund only. The Maintenance & Operations/General Operating Fund is used to account for the day-to-day operations of the District and does not include property taxes imposed or state funding allotted specifically to repay debt (Interest & Sinking/Debt Service Fund property taxes and state funding). The second is calculated using audited financial statement data for both the Maintenance & Operations/General Operating Fund and Interest & Sinking/Debt Service Fund. The district has no sales tax revenue.

A note on property values: Values are assessed by the County Appraisal Districts. Homeowners with questions should contact their Appraisal District directly:

- Harris County Appraisal District

- Fort Bend Central Appraisal District

- Waller County Appraisal District

- Texas Comptroller

Budget & Check Registers

Official budget information is presented for the current fiscal year and the previous seven fiscal years. This information presents data on the budget adopted for the District's Maintenance & Operations/General Operating Fund, Interest & Sinking/Debt Service Fund, and applicable Special Revenue Funds.

Check registers are presented for the current fiscal year and the previous five fiscal years. The registers present the date, payee, the amount paid and a brief description of the purchase. View the Budget & Check Registers section website for more information.

Annual Financial Reports, Awards & Bond Ratings

The District's Annual Comprehensive Financial Report for the prior 7 fiscal years is presented. This document presents audited financial information and additional information on the financial aspects of the District.

Awards earned by the District are noted and described in the Annual Financial Reports, Awards & Bond Ratings section of the transparency site.

The District's most recent bond ratings are presented from both Moody's Investor Service and Standard & Poor's.

Public Pension

This page provides information related to the district’s participation in the Teacher Retirement System of Texas (TRS).