Fund Balance

-

Katy ISD’s Fund Balance

- The District has approved an Administrative Regulation that governs the targeted optimum fund balance level.

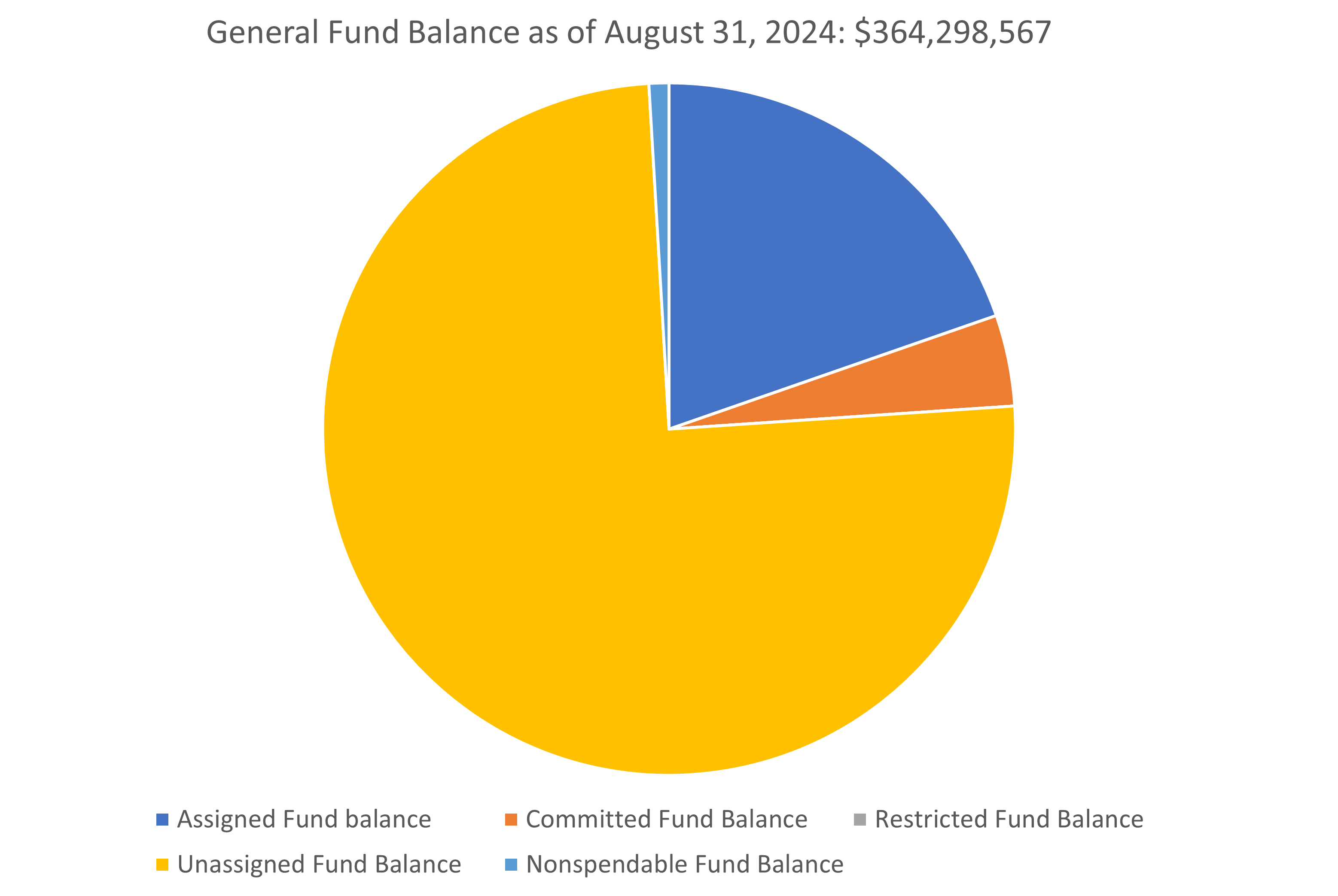

- Katy ISD Fund Balance as of August 31, 2024: $364,298,567

- Of this amount, $273,711,426 is unassigned

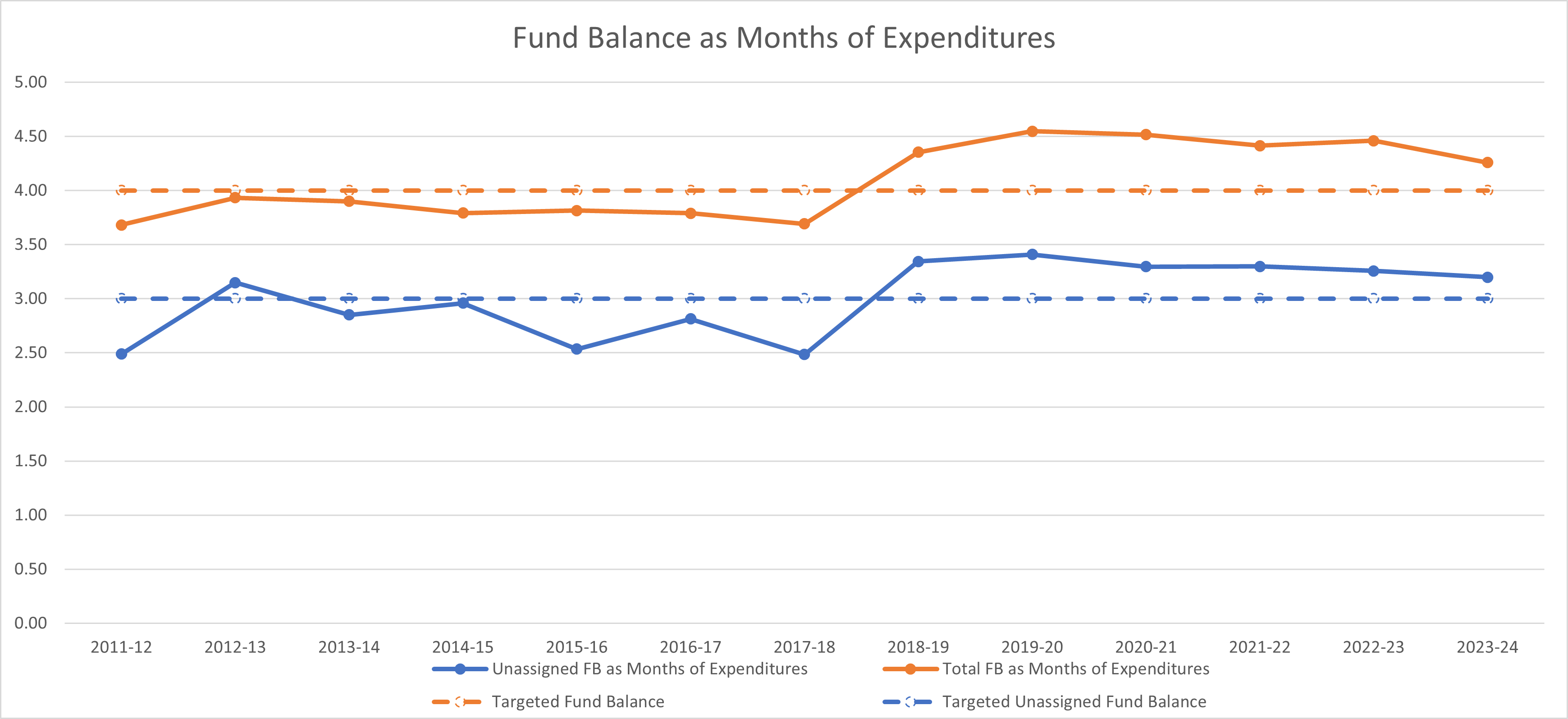

- Provides over 3 months of general fund expenditures or over 90 days

What are Fund Balances?

- Within the General Fund at the close of a fiscal year: Assets – Liabilities = FUND BALANCE

- The District uses the General Fund to pay expenses related to student instruction.

- Fund balances will fluctuate daily.

- Fund balances comprise several components: Nonspendable, Restricted, Committed, Assigned, or Unassigned (see pie chart below).

- The Board may resolve to commit a portion of the fund balance for a specific purpose.

- The committed portion of the fund balance is reserved for the purposes specified; however, the commitment may be amended by the Board at any time.

- The Chief Financial Officer is authorized to assign a portion of the fund balance as may be required to meet the financial needs of the District.

- Fund balances are the culmination of the Board’s financial decisions over many years.

A Fund Balance is NOT:

- A savings account

- A rainy day fund

- The result of unduly high taxes

The Importance of a Fund Balance Is:

- Cash management

- Eliminate or lessen the need for short-term borrowing costs

- Unforeseen expenditures and disasters

- Ongoing support for educational programs

- Lower interest rates on district bonds

- Best practices

How much Fund Balance should the District have?

- A commonly referenced guideline is that three months of expenditures should be kept in fund balance. This guideline is included by the Texas Education Agency (TEA) in the Financial Integrity Ratings System of Texas (Schools FIRST). For example, to receive full points on Indicator 6, school districts need 90 days of cash on hand or current investments in the General Fund.

- The Government Finance Officers Association (GFOA) recommends an unassigned fund balance of "no less than three months of regular general revenue operating expenditures.”

- A district’s need for fund balance can vary depending on cash flow needs and anticipated future costs. Two factors that can impact this need are fiscal year start dates and relative reliance on local property taxes.

What are the benefits of having a healthy fund balance?

Having a sufficient fund balance helps the District with the following: It can prevent the District from facing borrowing costs should the need arise to cover cash flow deficits. A healthy balance can help generate higher bond ratings, which results in reduced interest costs. This is particularly important in a fast-growth school district like Katy ISD.

Sufficient fund balance also allows the District to respond to unforeseen costs without interruptions in service. For example, when Hurricane Harvey hit, Katy ISD used a fund balance to cover short-term costs while we waited for help from insurance and FEMA. Our fund balance allowed for rapid repair of facilities and minimal service interruption.